Desarrollo psicomotor, hitos de los primeros años

conoce un poco más sobre la estimulación infantil y el proceso de desarrollo psicomotor de los niños y niñas

¿Me Puedo Hacer un Tatuaje Durante Mi Embarazo?

Explora la seguridad de tatuajes durante el embarazo y lactancia, con consejos y riesgos. Ideal para futuras madres.

DeepMind de Google y el Amancer de la IA Gamer

Descubre cómo tu próxima partida puede incluir a un socio digital que juega y aprende como tú.

Los aeropuertos más aclamados por viajeros a nivel mundial

Descubre cuáles son los aeropuertos que conquistan los corazones de los pasajeros ¡Continúa leyendo para saber más!

Lollapalooza: Festival de Música y Arte

El auge silencioso de la soledad: un desafío para la salud global

Estamos conectados digitalmente como nunca antes, pero paradójicamente enfrentamos una crisis de soledad global. Descubre por qué.

Una realidad alarmante: niñas y adolescentes, principales víctimas de violencia sexual

Descubre las escalofriantes cifras de agresiones sexuales a menores ¡Continúa leyendo para conocer más!

Caso de censura en Irán: Arresto de mujeres por danzar como icónico personaje

En un acto desafiante y simbólico, dos mujeres enfrentan la justicia iraní. Descubre por qué su danza es un acto de rebeldía.

La otra cara del exilio: Judíos de Medio Oriente y África del Norte

¿Sabías de la existencia de un éxodo poco conocido que transformó para siempre la vida de miles de judíos en Medio Oriente? Sigue leyendo y descubre u...

La ministra del Medio Ambiente se compromete a una mayor regulación tras la revisión de la OCDE

Explora la reacción de la ministra Maisa Rojas frente a los desafíos ambientales revelados por la OCDE e insta a un cambio normativo.

La Expogame 2024 en Santiago: Una celebración con estrellas de la voz en el mundo del gaming

¡La Expogame 2024 marcará una década de magia gamer! Descubre los pormenores de este inminente festín digital.

Impacto de los Frutos Secos en la Salud Cardiovascular

¿Buscas un corazón saludable? Descubre cómo los frutos secos pueden ser tus aliados.

Descubre si eres destinatario del Bono Logro Escolar 2024

¿Estás entre el 30% superior de tu clase? Podrías ser beneficiario del Bono Logro Escolar 2024.

El esperado regreso de 'Fortnite' a iOS en Europa: Una Nueva Esperanza para los Gamers

El gigante de los videojuegos se hace camino de regreso a los dispositivos Apple, pero solo para algunos afortunados. Descubre los detalles.

Cinco Revelaciones de tu Salud a través de la Sangre

Descubre cómo el análisis de tu sangre desvela secretos de tu bienestar. Sigue leyendo y conócelos.

El Intrincado Laberinto Migratorio: Biden, Trump y la Lucha en la Frontera

Descubre el complejo entramado fronterizo que enfrentan Biden y Trump, y las duras realidades que viven los inmigrantes.

Crisis en Gaza: Investigaciones en curso tras acusaciones a empleados de la UNRWA

Sumérgete en los detalles sobre las graves alegaciones que han puesto a una agencia humanitaria en el ojo de la tormenta.

Jannik Sinner: de la desventaja a la gloria en el Abierto de Australia

Descubre cómo Jannik Sinner reescribió la historia superando un inicio adverso. ¡Continúa leyendo para sorprenderte con su hazaña!

Insólito ataque a la Mona Lisa: Activismo y sopa en el Louvre

La icónica Mona Lisa fue blanco de un acto de protesta con sopa. ¿Qué mensaje encierra este acto insólito? Sigue leyendo para descubrirlo.

Cuidando a nuestros amigos caninos: Convivencia y atención con perros domésticos

Descubre cómo mantener la salud y bienestar de tus perros en el hogar. ¡Sigue leyendo para ser el mejor amigo de tu amigo!

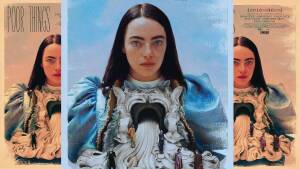

Emma Stone y su retorno triunfal con 'Poor Things' esta semana en cines

La pantalla grande recibe una sorpresa de gran calibre ¡Descubre qué esconde 'Poor Things' con Emma Stone!

El Desafío de Milei Frente a la Escalada del Dólar

Profundizar en la estrategia económica de Milei es vital. ¿Persistirá la incertidumbre cambiaria? Sigue leyendo.

Perspectiva Ambiental: El Futuro Incierto de las Playas Chilenas

Descubre qué playas icónicas de Chile podrían quedar en la memoria colectiva en tan solo una década.

El Cine Chileno Brilla con Dos Nominaciones en los Oscars

Chile celebra un hito en la historia del séptimo arte con dos nominaciones en los prestigiosos premios Oscar. Descubre los detalles y sigue leyendo.